Commentary

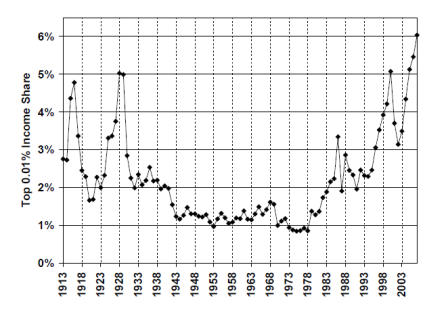

In his prescient but ill-timed bestseller, The Great Depression of 1990, Ravi Batra documented painstakingly the correlation between income disparity in the US and economic downturns. More recent scholarship from Berkeley Professor Emmanuel Saez has shown an alarming trend that explains the current financial melt down.The super-rich do not spend their money stimulating economic growth. They simply invest it or deposit it in some numbered account earning interest, relying on money managers to invest their money for them. As we have seen, money managers do not put the money in small businesses, or manufacturing businesses, or consumer goods, but simply play games on paper or electronic trades that inflate their earnings. The Great Depression was preceded by the biggest increase in income disparity. The Great Financial Meltdown was preceded by the biggest increase in income disparity. Similar increases in income disparity have caused proportional business downturns in the past, as shown by Ravi Batra.

If there is any reason to regulate compensation in the financial sector, it is to prevent similar recurrences in the future. We can be certain that left to themselves, these executives will certainly continue to give themselves raises.

Excerpts

Income inequality in the United States is at an all-time high, surpassing even levels seen during the Great Depression, according to a recently updated paper by University of California, Berkeley Professor Emmanuel Saez. The paper, which covers data through 2007, points to a staggering, unprecedented disparity in American incomes. On his blog, Nobel prize-winning economist and New York Times columnist Paul Krugman called the numbers "truly amazing."

Though income inequality has been growing for some time, the paper paints a stark, disturbing portrait of wealth distribution in America. Saez calculates that in 2007 the top .01 percent of American earners took home 6 percent of total U.S. wages, a figure that has nearly doubled since 2000.

As of 2007, the top decile of American earners, Saez writes, pulled in 49.7 percent of total wages, a level that's "higher than any other year since 1917 and even surpasses 1928, the peak of stock market bubble in the 'roaring" 1920s.'"

Beginning in the economic expansion of the early 1990s, Saez argues, the economy began to favor the top tiers American earners, but much of the country missed was left behind. "The top 1 percent incomes captured half of the overall economic growth over the period 1993-2007," Saes writes.

Despite a rising stock market, largely growing employment and a historic housing boom things were not nearly so rosy for the rest of U.S. workers. This trend, according to Saez, only accelerated during the George W. Bush's tenure as President:

"...while the bottom 99 percent of incomes grew at a solid pace of 2.7 percent per year from 1993-2000, these incomes grew only 1.3 percent per year from 2002-2007. As a result, in the economic expansion of 2002-2007, the top 1 percent captured two thirds of income growth."

No comments:

Post a Comment